AMD and OpenAI have made a huge announcement about their partnership, which has resulted in AMD stock skyrocketing by over 23.71%. It’s one of the biggest multi-billion-dollar deals made in the global AI hardware space. That’s giving AMD an edge against its rival chipmaker, NVIDIA, and causing a surge in AMD’s share price within a day of the announcement of this partnership. It’s a win-win deal for both of the biggest companies.

The deal made between them is that AMD will deploy 6 gigawatts of compute capacity to OpenAI across multiple generations of its Instinct GPUs. With the expectation that the MI450 GPU will be the first to start, deployment of the first 1 gigawatt is scheduled to begin in the second half of 2026. This has opened tens of billions of dollars in revenue for chipmaker AMD and will also accelerate its momentum in the AI industry.

This Partnership is leveraging OpenAI through a 10% stake acquisition of AMD, which will amount to 160 million AMD shares. Contingent upon performance milestones and share-price targets, this announcement is made by AMD following its partnership arrangement.

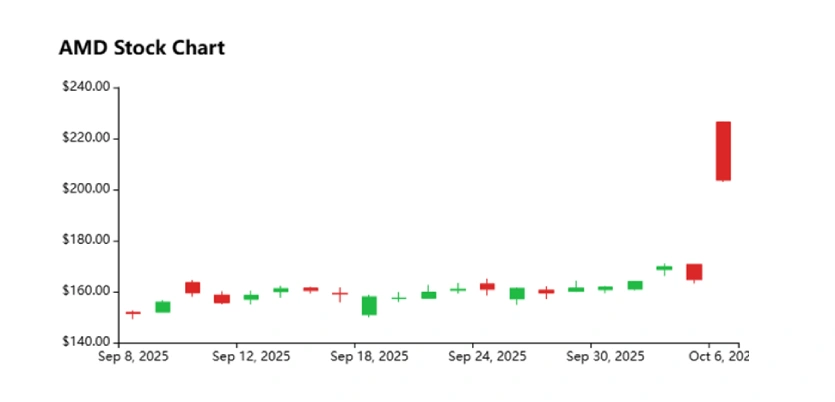

This chart displays the one-month statistics of AMD stock from September 8, 2025, to October 7, 2025.

| Price | Market cap | P/E ratio | 52-week range |

|---|---|---|---|

| $207.59 | $330.59B | 121.98 | $76.48 – $226.71 |

This is the statistical proof of how the last month’s stock performance was for AMD, and also how positively the market has responded. The tie-ups between two billion-dollar companies involve working on innovative projects in emerging sectors. AI is the future of this era, and everyone is well aware of this significant fact. That is why many companies are working to evolve themselves with artificial intelligence. And AMD has just got the upper hand in this race, also with great leverage over its rival in the semiconductor industry.

AMD leading in Semiconductor stock over NVIDIA, With One Deal With OpenAI

AMD headquarters is based in the heart of Silicon Valley in Santa Clara, California, USA. And it was initially founded by Jerry Sanders and his group of colleagues from Fairchild Semiconductor.

Advanced Micro Devices (AMD), which has been in the market for over 50 years, has significantly established its presence. Making it a reputation for reliability and high-quality manufacturing. Initially, they started as a second-hand processor supplier of microchips to ensure a stable supply in the market, and over time, they grew into a billion-dollar industry.

While AMD’s historical rivalry was with Intel in the CPU (Central Processing Unit) market, its most heated contemporary rivalry is with NVIDIA in the GPU (Graphics Processing Unit) and AI (Artificial Intelligence) markets. In the upcoming time, the company that leads in AI hardware will shape the next decade of computing.

The Evolutionary Journey Of AMD Over The Years

1980s-1990s: Its fame started with the its x86 processors, which challenged Intel’s dominance in CPUs of PC.

2000s: The second and highest growth was achieved by ATI Technologies in 2006, when it entered in the graphics processing unit (GPU) market.

2010s-Present: After the huge presence in the GPU market. Now, under CEO Lisa Su (who took the position in 2014), AMD has built a remarkable turnaround. By shifting its focus from high-performance computing, data centers, and gaming to AI accelerators, such as the Instinct series of GPUs. This spin has been one of the primary reasons for its recent stock surge, particularly with the extraordinary growth in demand for AI.

AMD is the competitive challenger with its powerful hardware (such as the Instinct MI300) and is aggressively pushing an open-source alternative to CUDA to break NVIDIA’s dominance.

Here’s a Short Comparison of AMD with NVIDIA

| Feature | AMD | NVIDIA |

|---|---|---|

| Primary Battlefield | GPUs & AI Accelerators | GPUs & AI Accelerators |

| GPU Brands | Radeon, RDNA Architecture | GeForce, CUDA Architecture |

| AI Chip Focus | Instinct MI300 Series | H100, A100, “Blackwell” B200 GPUs |

| Key Strength | Competitive performance and pricing, strong integration with its own CPUs (e.g., Ryzen + Radeon). | Dominant market share in AI datacenters, industry-standard CUDA software platform for developers. |

| The “MoAT” (Moat) | Pushing an open-software ecosystem (ROCm) to challenge NVIDIA’s walled garden. | CUDA. Its vast software library and developer loyalty create a massive barrier to entry for competitors. |

| Market Position | The aggressive challenger is gaining ground with compelling hardware and strategic partnerships (like the recent OpenAI news). | The established leader and king of the AI chip market, setting the pace for innovation and performance. |

Today, AMD has made a significant presence in the industry and is now one of the fabless semiconductor companies (meaning it primarily outsources its manufacturing to TSMC in Taiwan while handling the design of chips itself). With a market capitalization of around $200 to $250 billion (as of 2023), it is a major tech giant that focuses on CPUs (Ryzen), GPUs (Radeon), and AI hardware.

AMD also claimed that its MI450 series will outperform NVIDIA’s (Rubin CPX) through major software and hardware improvements. Most of which will be made with the input of OpenAI, as its current GPU series, such as the MI355x and MI300X, is used in some of the workloads. They are coming as strong for the large language model of AI interference due to their capacity for large memory bandwidth. The significant impact of this deal has already been showing in AMD stock, as the shares closed at $164.67 on Friday and started at $222.24 on Monday, resulting in a 35% growth. As news of the deal spread worldwide, it generated excitement in semiconductor stocks.

The CEO’s Take On This Partnership

Dr. Lisa Su, the chair and CEO of AMD, stated that “We are thrilled to partner with OpenAI to deliver AI compute at massive scale,” adding “This partnership brings the best of AMD and OpenAI together to create a true win-win, enabling the world’s most ambitious AI buildout and advancing the entire AI ecosystems.”

And Sam Altman, CEO of OpenAI, stated that “The partnership is a major step in building the compute capacity to realize AI’s full potential,” adding, “AMD’s leadership in high-performance chips will enable us to accelerate progress and bring the benefits of advanced AI to everyone faster.”

Greg Brockman, Co-founder and President of OpenAI, said, “Building the future of AI requires deep collaboration across every layer of the stack.”

Final Words!

The rise in the AMD share price indicates the company’s successful transformation from being a struggling semiconductor player to a significant industry competitor, giving it an edge in this highly competitive market analysis and the emerging technology world. Choosing to invest now can be game-changing, as many leaders have taken highlighted steps indicating their belief, such as JEFFERIES upgrading AMD to “Buy” from “Hold,” significantly raising the target from $170 to $300, followed by Barclays and Stifel.