The bank nifty has conquered the milestone, as it reaches the market cap of ₹50 Lakh Crore. As of December 1, 2025, the bank nifty index is trading at ₹59,996.10, up by 0.41%. After the previous closing of ₹59752.7, it opens on Monday, the first day of December. It hits the milestone achieved at the index’s opening, which is unexpectedly grand. The index breached the ₹60,000 level for the first time ever, opening at ₹60,102.05. Furthermore, it touched a high of ₹60,114.30 and a low of ₹59,888.35. This marks a landmark moment in Indian stock market history, setting a new all-time high record.

Over the past 52 weeks, this index has moved between a low of ₹47,702.90 and a high of ₹60,114.30. This showcases the performance of the Indian banking sector, comprising the top 12 banks. The Nifty Bank index has gained approximately a 17% rise after this breakthrough in 2025. Significantly, outperforms the broader Nifty50 index by 10.7% year to date. The List of the 12 top influential banks in the Nifty Bank.

| Sr. No. | Stock Name | Sector | Approx. Weightage |

|---|---|---|---|

| 1 | HDFC Bank | Private Sector | 28-30% |

| 2 | ICICI Bank | Private Sector | 22-24% |

| 3 | State Bank of India | Public Sector | 10-12% |

| 4 | Kotak Mahindra Bank | Private Sector | 9-10% |

| 5 | Axis Bank | Private Sector | 9-10% |

| 6 | IndusInd Bank | Private Sector | 5-6% |

| 7 | Bank of Baroda | Public Sector | 3-4% |

| 8 | Punjab National Bank | Public Sector | 2-3% |

| 9 | Federal Bank | Private Sector | 2-3% |

| 10 | IDFC First Bank | Private Sector | 1-2% |

| 11 | Bandhan Bank | Private Sector | 1-2% |

| 12 | AU Small Finance Bank | Small Finance Bank | 1-2% |

In the list of Bank Nifty’s 12 constituents, the three largest banks account for 70% of the index alone. Starting with HDFC Bank, it leads the market with a market value of ₹15.5 lakh crore. Closely followed by the ICICI Bank for ₹10 lakh crore and the SBI (State Bank of India) at a little over ₹9 lakh crore. Meanwhile, on a closer look, HDFC Bank and ICICI Bank together account for more than half of Nifty Bank’s total valuation.

Contribution of PSU banks and Heavy FPI Inflow for Bank Nifty

The historic high for Nifty Bank on 1st December 2025 was achieved after a record-setting week for financial stocks. Last Wednesday, we saw the 700-point surge in the banking index, which closed at 59,528.05. Followed by another record high on Thursday, climbing to 59,802.65. PSU banks and heavy FPI inflows supported this rally in the high index. Monday, when the index reached 60,000, it was led mainly by the State Bank of India. Which rose to 0.9 percent to Rs. 987.7, Kotak Mahindra Bank advanced with 0.8 percent to Rs. 2,140.9.

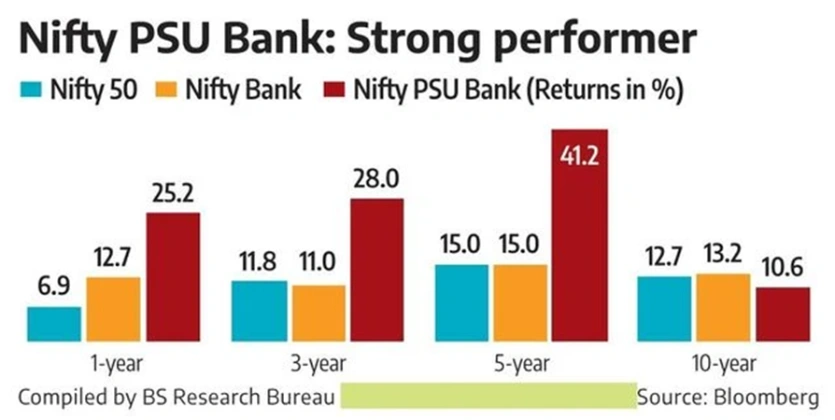

Followed by Punjab National Bank, which contributed with 0.6 percent to Rs. 125.13. Federal and IndusInd Bank were a little lower, adding 0.3 percent each to Rs. 257.15 and Rs. 856.15, respectively. The Nifty PSU Bank has made a good contribution to this remarkable achievement. According to recent reports, this PSUB Bank has surged 25.2% over the past year. This surge has been fueled by improving asset quality, declining NPAs, and robust credit growth, especially in infrastructure and retail lending. The image below represents the growth of Nifty PSU Bank.

For Image Reference:

While private banks provided the bulk of weight in the 60,000 rally, PSU banks have supplied the momentum. Their rally, led by SBI and Bank of Baroda, was crucial for the Nifty Bank Index to reach and pass the historic 60,000 mark.

- PSU Bank Index surged up to 25% YoY, outperforming all the private banks in credit growth.

- SBI alone contributes approximately 3.4% to the Bank Nifty weight, making it the most influential PSU bank.

- Meanwhile, private banks (HDFC, ICICI, Axis, Kotak) accounted for the majority of the index’s weight (approx. 70%).

Contribution of PSU Banks vs Private Banks in Nifty Bank Rally

Short table breakdown of contributions from both public and private sector banks. The breakdown is based on the approximation of the numbers and percentages. Showcasing the banks of both the public and private sectors that have made considerable contributions to this breakthrough.

| Bank Name | Market Cap (₹ lakh crore) | Weight in Bank Nifty | Recent Performance | Contribution to Rally |

|---|---|---|---|---|

| State Bank of India (SBI) | 9 | 3.40% | Rose ~0.9% on Dec 1 | Largest PSU contributor; strong credit growth |

| Bank of Baroda | 1.2 | 0.50% | Rose ~0.6% | Added momentum with high trading volumes |

| Punjab National Bank (PNB) | 0.9 | 0.40% | Minor gains | Supported index, but with a smaller weight |

| Union Bank of India | 0.7 | 0.30% | Flat | Limited impact |

| Indian Bank | 0.6 | 0.20% | Positive | Helped PSU index strength |

| HDFC Bank | 15.5 | 13% | Strong gains | Dominant driver of Bank Nifty |

| ICICI Bank | 10 | 8.30% | Positive | Major contributor |

| Axis Bank | 4 | 3.10% | Positive | Supported rally |

| Kotak Mahindra Bank | 3 | 2.50% | Positive | Added incremental push |

What is Bank Nifty & Its Journey to 60,000?

Bank Nifty is a stock market index. It’s a sectoral index comprising the 12 most liquid and large capitalization banking stocks. Listed on the National Stock Exchange (NSE) of India, this was launched in September 2003. The base date is January 1, 2000, with a Base value of 1000 and 12 stocks. Free-float market capitalization is used to calculate this. Let’s look at the journey of Bank Nifty reaching this historic milestone.

1. First Major High at 10,000 (2007–2008)

Achieved in about 7 years, marking the first big rally before the global financial crisis.

2. Post-Crisis Low at 4,000 (Mar 2009)

A sharp fall during the global financial meltdown, representing the crisis’s bottom.

3. Recovery to 15,000 (2014)

Took approximately 5 years to rebound, reflecting steady growth and stabilization.

4. Pre-COVID High at 32,000 (Jan 2020)

A significant milestone was reached approximately 6 years earlier, just before the pandemic shock.

5. COVID Crash Low at 16,000 (Mar 2020)

A dramatic 50% crash within weeks, underscoring pandemic-driven volatility.

6. Recovery to 40,000 (2021)

A swift rebound in just ~1 year, fueled by liquidity and optimism.

7. Major Milestone at 50,000 (2024)

Reached in ~3 years, consolidating post-pandemic growth.

8. Historic High at 60,000 (Dec 2025)

Achieved in ~1 year, marking the fastest climb in recent history and a symbolic peak for the banking index.

It’s Time to Wrap Things Up!

After a period of continuous rise and fall over about 22 years, the Indian stock market has finally reached a high, with the index closing at 6,000. It was a new high for the Indian stock market, reflecting tremendous growth and boosting investor confidence. Although the rise and fall are continuous, analysts see this as a good sign. On a year-to-date basis, Nifty Bank has surpassed Nifty50 and other indices and has shown a growth of 17%, which is unexpected and very positive. With the Bank Nifty breaching 60,000 for the first time and hitting fresh peaks, the market enters December on a strong footing, backed by liquidity and rate-cut expectations. This is a sign of future growth.

Frequently Asked Questions

Q1: What is the Bank Nifty All-Time High Index and When?

Ans: Bank Nifty crossed the highest with a 60,000 index for the first time ever on 1st December 2025. Making history for an all-time high opening.

Q2: How Many Stocks are There in Bank Nifty?

Ans: There are a total of 12 banking stocks in the Bank Nifty, including HDFC Bank, ICICI Bank, SBI, Kotak Bank, Axis Bank, and others.

Q3: What is the Bank Nifty Lot Size?

Ans: The lot size for Bank Nifty is 15 units.

Q4: What is the Market Cap of Bank Nifty Stocks?

Ans: Combine the market capitalization for Bank Nifty constituents that have crossed 50 lakh crore.

Q5: Can Bank Nidty Reach 70,000?

Ans: Based on the current growth trajectory and fundamentals, analysts expect the Bank Nifty to reach 7000-7500 over the next 12-18 months.